Enjoy complimentary access to top ideas and insights — selected by our editors.

When Rocket Companies announced the purchase of

More recently, the

1. Compass

2. Anywhere Advisors

3. eXp Realty

4. HomeServices of America

5. Douglas Elliman

6. Hanna Holdings Inc.

7. Redfin

8. @Properties

9. Side

10 The Real Brokerage Inc.

What is driving the consolidation of not just real estate brokerage, but all aspects of the world of making and servicing mortgages? Our friends on the Federal Open Market Committee, of course. While

In Q1 2020, the mortgage industry did just over $560 billion in total mortgage production, but by Q4 2020 that figure had exploded to over $1.1 trillion. In Q4 2024, on the other hand, volumes fell to below $600 billion and a sub-$400 billion quarters may be in prospect for 2025.

The sharp decline in mortgage production volumes has, in turn, put a premium on leads for new mortgage loans and also on mortgage servicing rights. Bulk purchases of MSRs have reached short-term records, although not nearly the peak levels seen in the 1990s, when MSRs touched almost 8x annual cash flow.

Of course, not everybody in mortgage finance hates rising interest rates. Freedom Mortgage founder and CEO Stan Middleman recalled

The fact of increasing scarcity of new loan assets is forcing the larger players to spend cash to acquire loans and defend MSR portfolios. If you appreciate that the true cash gain on sales for loans is limited or nonexistent, retaining the MSR and potentially refinancing a customer, is the only reason to be in the residential mortgage business.

Most of the larger, better-managed independent mortgage banks are raising term debt in the capital markets to support existing and new MSRs. Most recently, REIT Rithm Capital just issued $875 million of fixed-rate term notes secured by approximately $85 billion UPB of Freddie Mac MSRs.

Brad Finklestein reported last month that Rithm just

But Rithm could use the SPAC for other acquisitions to support growth, possibly even a real estate broker. That brings us back to real estate brokerage firms as part of larger, vertically integrated real estate finance companies. The realtor acts to attract new loans and retain existing loans in the IMB’s servicing portfolio. Once the realtor is inside the walls of these modern day medieval castles, all of those nasty RESPA violations can go away, you know?

A growing portion of the mortgage finance market believes that realtors and loan officers are going to merge functions over time. Having realtors who are also licensed as loan officers may actually address some of the conflicts which historically dissuaded lenders from acquiring real estate companies.

But even if the realtor and IMB are run separately under common ownership as with Rocket and Redfin, the potential for powerful synergies seems obvious given the heightened value of loans and MSRs. For an IMB, refinancing a mortgage already in portfolio is a home run and can equal years of servicing income.

“Rocket Companies will benefit from Redfin’s nearly 50 million monthly visitors, 1 million active purchase and rental listings and staff of 2,200+ real estate agents across 42 states,” the company writes. Secondly, it expects that will drive growth in the purchase of its mortgages,

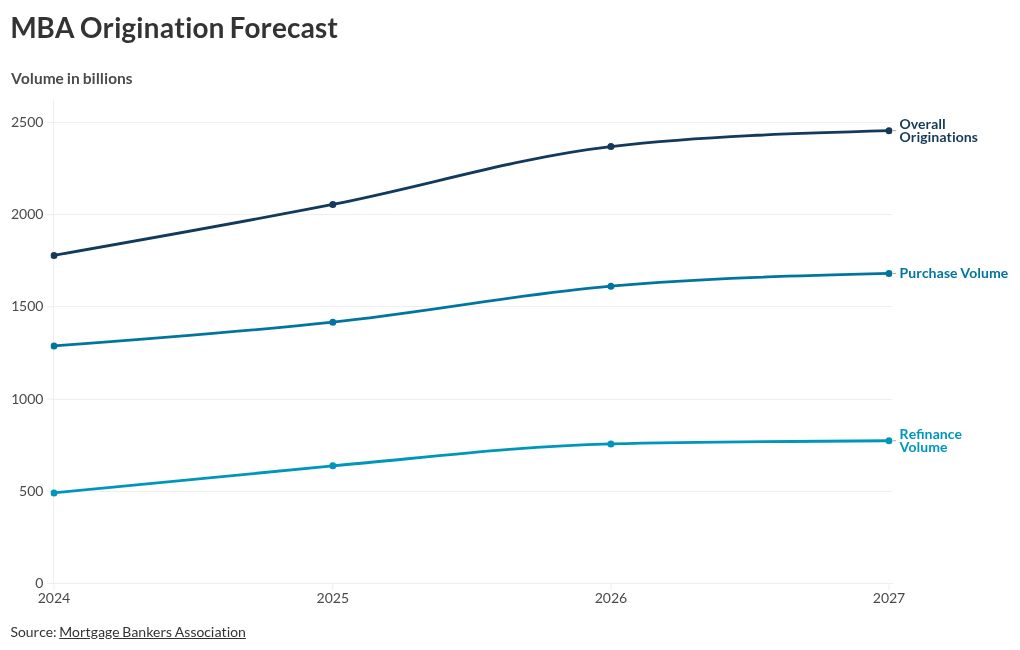

We expect to see the industry continue to consolidate and, more significantly, integrate vertically because mortgage interest rates are likely to remain elevated for an extended period. In this environment, IMBs are likely to get creative when it comes to originating and retaining new MSR assets.

“We like how Rocket’s acquisition of Redfin reinforces the increasingly relevant and valuable opportunity for mortgage originators to leverage consumer data,” write Eric Hagen and Jake Katsikas at BTIG.

They add: “We don’t think the combination shifts the near-term competitive dynamic in the market, although longer-term it could be a source for building scale and taking market share.”

One firm that took a lot of market share in 2024 was Freedom, which passed Rocket in the industry rankings as they leaned into the correspondent market for conventional loans and also bulk MSRs. Could loans and servicing assets get back up to the levels of the late 1990s?

Loan coupons and thus escrow balances on residential mortgages were higher in the 1990s, but today the growth in property taxes and insurance costs is pushing up escrows and thus the value of the MSR. But perhaps the biggest factor in rising MSR valuations is the increased value of the loan and the customer relationship given interest rates and lending volumes.

“Based on some very recent execution levels it’s hard to deny that prices are trending higher,” notes Mike Carnes at MIAC. “For years, the market has operated based on the presumption that ‘normal’ turnover would result in a lifetime Conditional Prepayment Rate of no less than 6% but for at least Covid-era originations that is no longer the case.”

He continues: “For the most attractive MSR offerings, some buyers seem willing and able to bid at lifetime CPRs in the mid 4% range. The other factor in support of rising MSR prices is recapture and the growing number of buyers willing to compensate sellers for potential recapture opportunities.”

“We have seen the highest MSR valuations since the 1998-1999 era,” Stan Middleman tells NMN. “Mutiples are driven up by relative note rates being low and relatively strong short term rates. But around every corner lurks change.”