The growth in multifamily debt outstanding continues to outpace the overall commercial real estate sector, marking the second and a half year of this trend, according to the Mortgage Bankers Association. As of December 31, 2024, commercial and multifamily mortgage debt stood at $4.79 trillion, reflecting a 1.1% quarter-over-quarter increase ($50.7 billion) and a 3.7% year-over-year rise ($172 billion).

Multifamily alone saw a 1.8% increase of $38.9 billion during the quarter with a notable 5.4% growth year-over-year ($111 billion). Almost 56% of the growth in multifamily debt outstanding (MDO) was driven by federal agency portfolios and mortgage-backed securities from government-sponsored enterprises Fannie Mae and Freddie Mac.

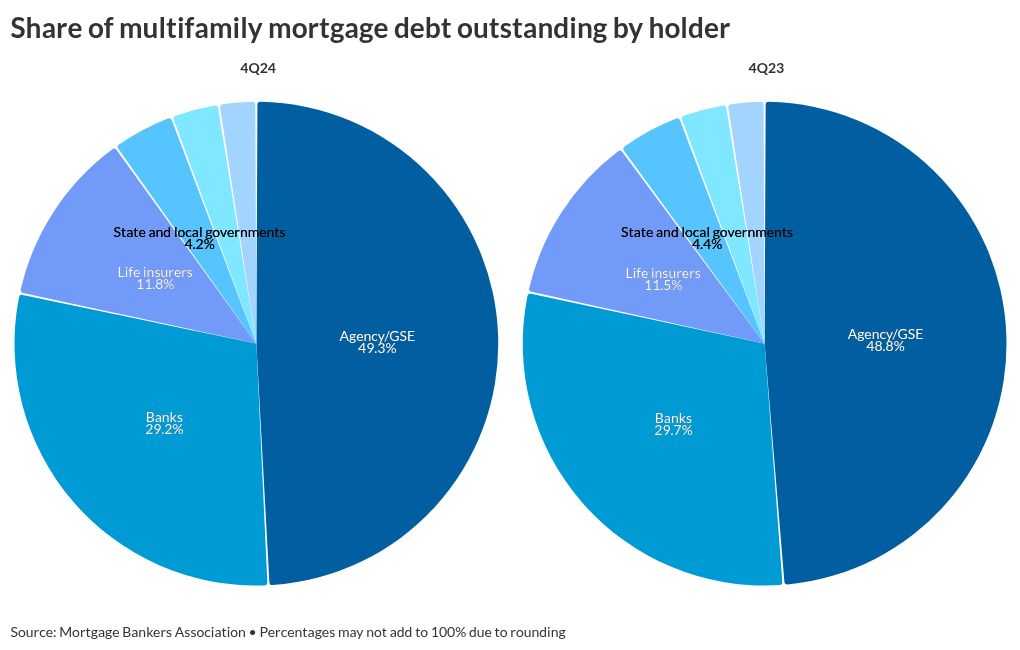

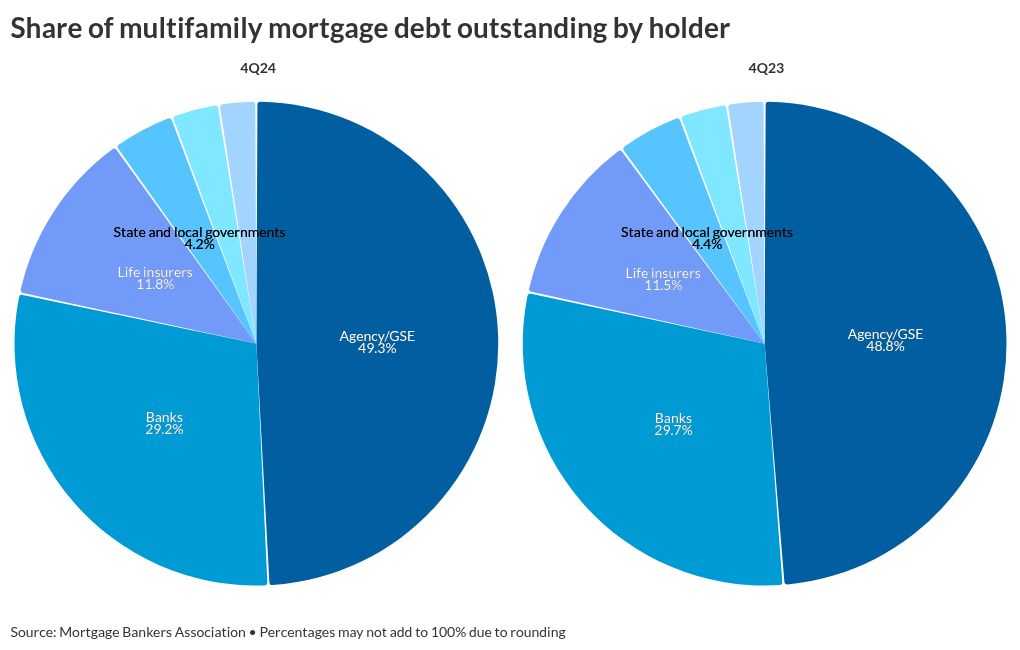

At the close of 2024, GSEs held the largest share of multifamily debt outstanding at $1.1 trillion, or 49% of the market. Their portfolios grew by $31.2 billion quarter-over-quarter, significantly contributing to the sector’s overall $38.9 billion increase. Commercial banks followed with the second-largest share, holding $629 billion (29%), while life insurers held $255 billion (12%), and state and local governments and mortgage securitizers rounded out the top five.

Despite this growth, the multifamily market faces challenges in bridge lending. Analysts Jade Rahmani and Jason Sabshon from Keefe, Bruyette & Woods noted that new construction starts for multifamily properties have declined, which could lead to improved rent growth later in 2025. However, they also warned that delinquencies in bridge loans supporting commercial real estate collateralized loan obligations have increased, signaling potential property cash flow issues linked to higher short-term rates.

For all forms of commercial real estate debt, banks have the largest share at 37.6% or $1.8 trillion, followed by the GSEs (which are strictly multifamily) at 22%. However, several banks, i

Following his confirmation as Federal Housing Finance Agency director last week, Bill Pulte wrote

Meanwhile, Department of Housing and Urban Development Secretary Scott Turner has also spoken of the need for more affordable housing. The market is awaiting further guidance from both Turner and Pulte as their policies take shape.

Last November, when the FHFA was still run by Sandra Thompson but after Election Day, the regulator

But in a National Mortgage News column, Christopher Whalen opined that any push by the Trump Administration