Running low on capital to fulfill large orders or meet seasonal demand can put your business in a tough spot. Without enough cash flow, keeping up with orders is hard, and you risk losing out on growth opportunities.

Inventory financing could be the solution to get you the capital you need when you need it most. In this article, we’ll explore how inventory financing works and how it can help your business stay ahead, even during peak seasons.

Table of Contents

What is Inventory Financing?

Inventory financing is a type of credit that provides businesses with short-term capital using inventory as collateral. It includes inventory loans and business lines of credit.

Lenders typically finance 50%-85% of the inventory’s value. If a company defaults, the lender can seize the inventory instead of other assets.

This financing option is ideal for businesses that need to quickly restock or fulfill large orders, especially small to medium-sized businesses or those with seasonal demand.

How Does Inventory Financing Work?

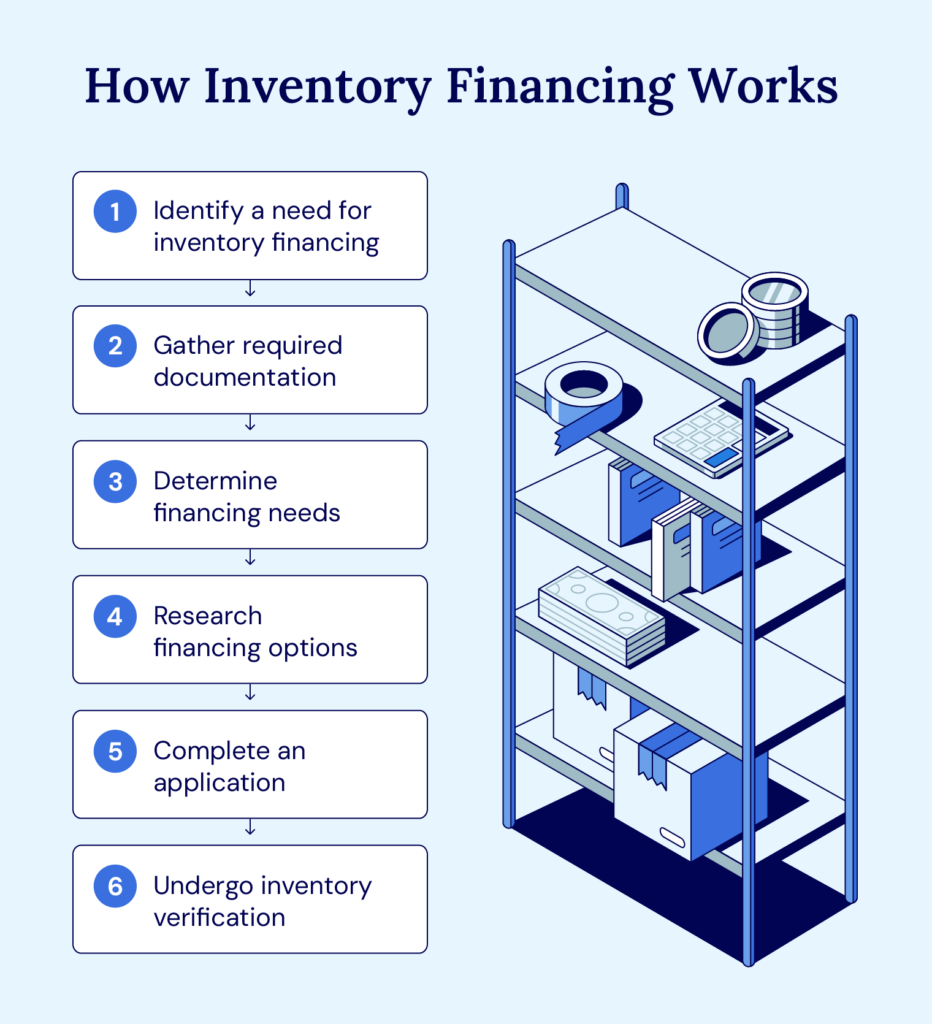

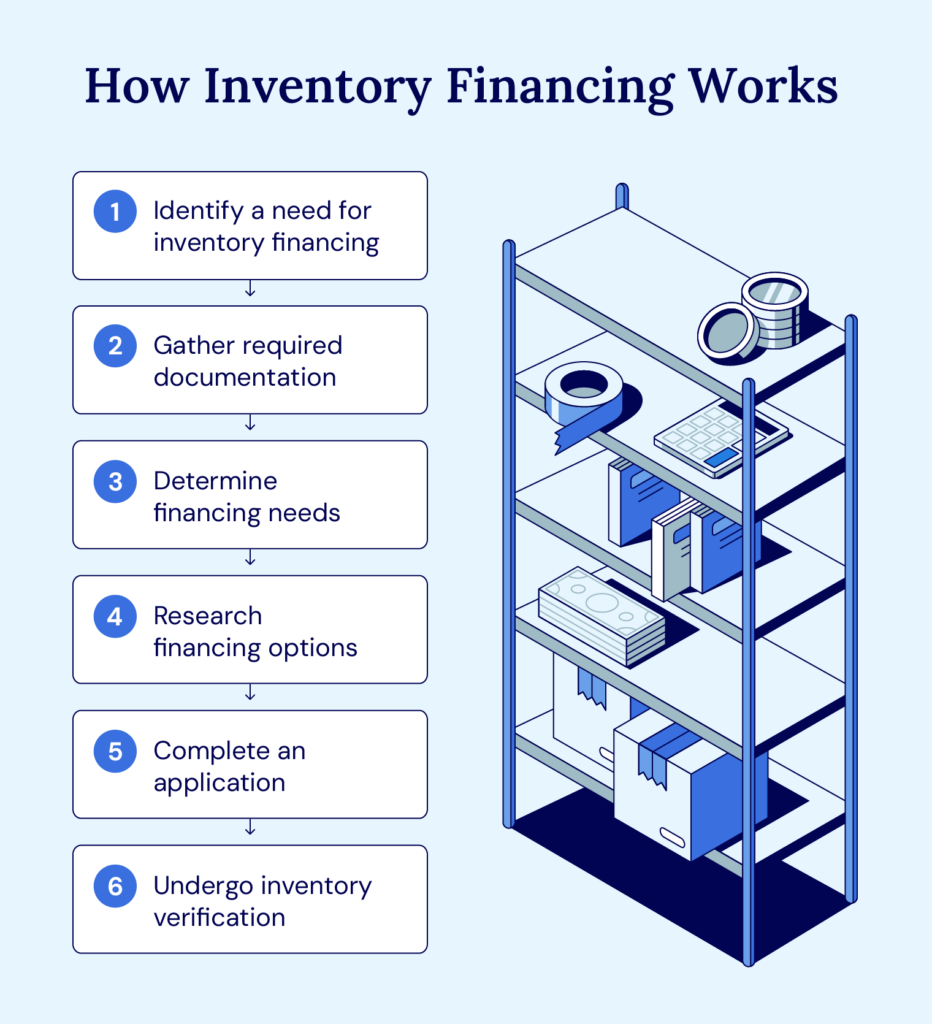

Inventory financing can be a game-changer for businesses, particularly during peak seasons or when an urgent order comes in. Here’s how the process typically works:

- Identify a need for inventory financing: Recognize when you need capital to restock, fulfill large orders, or prepare for busy seasons.

- Gather required documentation: Compile necessary paperwork including business financial statements, tax returns, inventory records, and more showing how the financing will support growth.

- Determine financing needs: Calculate exactly how much funding you need based on current inventory levels, sales projections, and purchasing requirements. Be precise about the amount and timing to avoid over-borrowing.

- Research financing options: Evaluate different options from traditional banks and private credit lenders to find the best terms and rates.

- Complete an application: Submit your application with the lender of choice, typically involving online forms and documentation uploads, followed by a potential in-person or virtual meeting to discuss your needs and answer questions.

- Undergo inventory verification: Allow the lender to conduct due diligence on your inventory, which may include physical inspection, and verification of your inventory tracking systems to determine the collateral value that will secure the financing.

Inventory financing ensures businesses don’t miss out on growth due to a lack of capital. It provides the flexibility to manage cash flow and capitalize on opportunities before selling inventory.

What Are the Types of Inventory Financing?

The two main types of inventory financing are inventory loans and inventory lines of credit. Let’s review the main features of these financing options:

- Inventory loans: These work similarly to traditional term loans but focus on inventory as collateral instead of your credit score. Lenders assess the liquidation value of your inventory to determine how much you qualify for. They then disburse the loan funds as a lump sum, which you repay through regular installments.

- Inventory lines of credit: This type of financing offers ongoing access to capital. You can draw funds from a line of credit as needed, and once repaid, the credit is available to use again. Lenders only apply interest to the amount you draw – not the full credit limit.

Choosing between a business loan or a line of credit depends on your cash flow needs and growth goals.

What Are the Pros of Inventory Financing?

Inventory financing offers significant advantages for businesses with large amounts of inventory, including the following:

- Unlock capital from unsold inventory: Instead of letting unsold inventory take up space, you can use it to access much-needed capital.

- Boost operations during busy seasons: Leverage your inventory to maximize profit and ensure you have the cash to operate at your highest capacity during peak periods.

- Bypass credit score barriers: Your credit score doesn’t play a major role because the lender can take the inventory in case of default.

- Enhance purchasing power: Unsold inventory can be a hidden asset. You gain access to capital by leveraging those products, boosting your business’s purchasing power.

- Act on opportunities quickly: Opportunities don’t always come at the right time. Inventory financing allows you to quickly create liquidity and seize growth opportunities.

While it may not be the ideal fit for every business, inventory financing can be a powerful tool to help you stay ahead of the competition.

What Are the Cons of Inventory Financing?

There are several potential downsides to consider before choosing inventory financing, such as:

- Inventory appraisal limitations: Lenders may only offer a percentage of your inventory’s value, which could leave you with less capital than expected.

- Interest costs: The longer you hold the loan, the more interest you may accrue, which can impact your profitability.

- Collateral risk: If you can’t repay, your inventory is at risk of being seized, potentially affecting your operations.

- Limited flexibility: Unlike general loans, inventory financing is restricted to specific inventory, limiting your ability to access other forms of capital.

Understanding how the different types of collateral work in business financing is key when considering the risks associated with inventory financing.

Explore Your Best Financing Options

Inventory financing can be a powerful solution for businesses needing to unlock capital quickly. It allows you to leverage your existing inventory to cover operational costs and seize growth opportunities.

Understanding the ins and outs of inventory loans and lines of credit is essential, as each option has its own benefits and challenges. With the right lending relationship, you can ensure you’re making the best decision for your business’s financial health.

Leveraging expert guidance from National Business Capital will help you navigate the technicalities of inventory financing.

Apply now to supercharge your business growth with inventory financing!