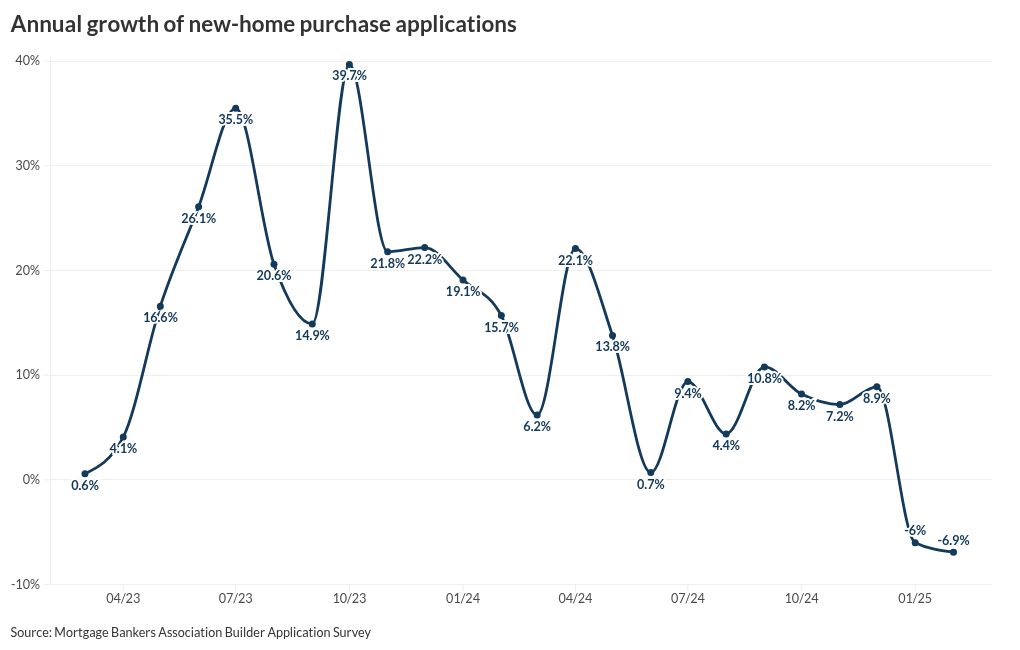

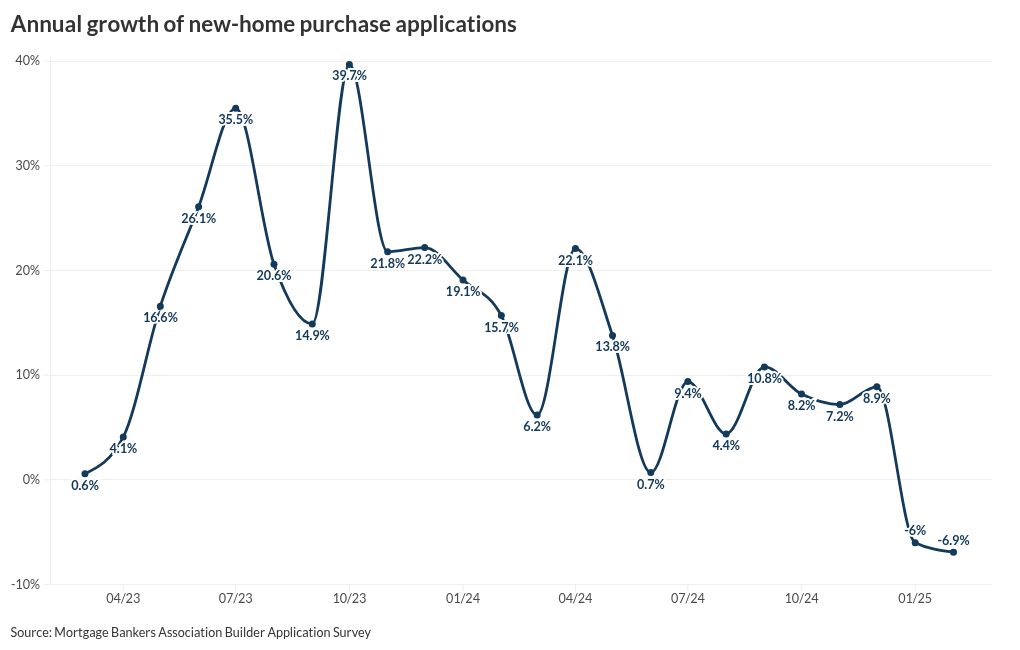

After nearly two years of steady growth, new-home loan applications fell for the second straight month, though seasonal demand remained strong, the Mortgage Bankers Association reported.

New-home mortgage applications fell 6.9% year over year in February, a steeper decline than January’s 6% drop, according to the Mortgage Bankers Association. The decrease ended a

“New-home purchase activity strengthened in February, in line with seasonal patterns, as higher housing inventory and declining rates supported growth,” said Joel Kan, MBA vice president and deputy chief economist, in a press release.

The seasonally adjusted pace of new-home sales picked up for the second consecutive month As a result, sales reached approximately 634,000 units, rising 2.9% from 616,000 in January.

“MBA’s estimate of seasonally adjusted new home sales increased for the second consecutive month to its highest pace in three months,” Kan added. In comparison to the same time last year, purchases ran at a rate of 689,000 units.

Total sales, nonadjusted, came out to 57,000 last month, according to the trade group’s estimates. The number rose 1.8% from 56,000 in January.

The recent declines could signal a slowdown in new-home sales for 2025. Over a multiyear stretch marked by a dearth of existing-sales inventory and homeowners’ reluctance to sell, new constructions proved to be a bright spot, leading to regular year-over-year increases in mortgage applications for new constructions beginning in February 2023.

Recent political developments have dampened some enthusiasm among prospective buyers, who continue to be dogged by elevated prices.

At the same time, new market listings for existing homes increased over the winter, creating more options for buyers, according to recent reports from real estate brokerage Redfin.

Much of the recent interest in newly built homes has come from buyers taking out mortgages backed by the Federal Housing Administration, commonly used to purchase starter properties. In February, the slice of activity made up by FHA applications came in at 32.1%, MBA determined.

“The FHA share of applications reached its highest share in the survey,” Kan said.

Conventional loans comprised a majority of all applications with 56.7%. Meanwhile, applications sponsored by the Department of Veterans Affairs made up 10.6%. The remaining 0.6% came from U.S. Department of Agriculture programs.

In February, the average loan size on new-home mortgages decreased by 1.5% month to month to $397,516 from $403,416. The decline showed “that first-time homebuyers remain active in the new-home purchase market,” Kan said.

The dip in loan size suggests first-time buyers are still active, but with affordability concerns rising, it remains to be seen whether demand will hold.