Bloomberg News

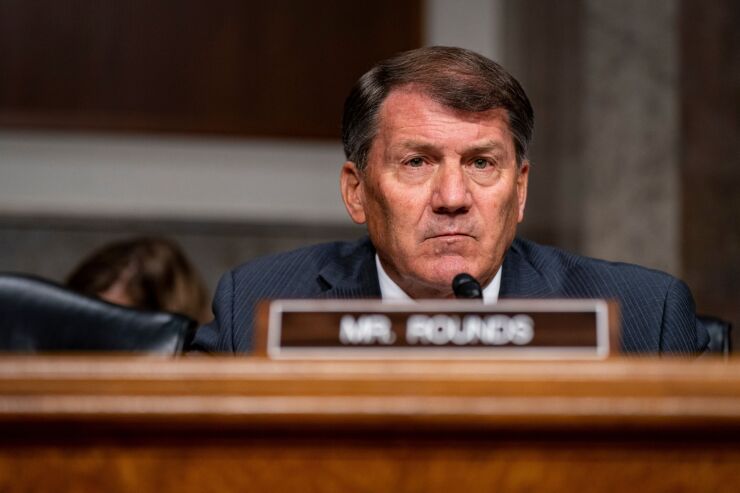

Sen. Mike Rounds, R-S.D., on Wednesday filed a resolution to repeal a rule issued by the Consumer Financial Protection Bureau that would forbid medical bills from appearing on consumer credit reports.

Rounds filed the resolution under the Congressional Review Act, which allows Congress to nullify any rule finalized within 60 legislative days by a simple-majority vote. When a final rule is rescinded under the CRA, the agency is barred from issuing a substantially similar rule in the future.

Rounds said the medical debt rule exceeds the CFPB’s statutory authority because it seeks to change the Fair Credit Reporting Act, which explicitly allows consumer reporting agencies to include coded medical debt information in credit reports.

“The CFPB going beyond their statutory authority to eliminate all medical debt from credit reports is irresponsible and a clear example of regulatory overreach,” Rounds said in a press release. “This rule gives credit card companies a less clear credit picture of who they’re lending money to, which could lead to banks limiting access to capital for consumers.”

The

Rep. Norman Ralph, R-S.C., introduced a companion

The CFPB’s medical debt rule — which was issued on Jan. 7 — would restrict credit reporting agencies from providing medical account information on credit reports. Consumers would still owe medical debts, but lenders would no longer see medical bills on credit reports and would be banned from considering medical debts in underwriting decisions.

The CFPB was

In 1996, Congress prohibited medical debt from being reported to credit bureaus — but then reversed itself in 2003 and created an exception to allow medical debts to be reported with special coding that removed the names of medical providers and types of services.

Currently, nearly all CFPB rules that were issued in the past six months of the Biden administration have been put on hold, pending a review by the Trump administration.

Republicans in Congress have already advanced two Congressional Review Act resolutions that would nullify the CFPB’s

Last week, the House Financial Services Committee voted 30 to 19 to

The Senate also is considering a CRA resolution on the CFPB’s

Before 2017, the Congressional Review Act had been used successfully only once, in 2001, to

The legislation overturning medical debt on credit reports is endorsed by the American Bankers Association, the U.S. Chamber of Commerce, ACA International, the Receivables Management Association International, the Online Lenders Association, the American Financial Services Association and the Innovative Lending Platform Association.